Bitcoin is preparing for a short-term recession that could see it lose a good chunk of its recent gains, even if the long-term outlook looks good for the world’s No. 1 cryptocurrency.

This is the opinion of several analysts after the BTCUSD bitcoin prices,

breached a key technical level following the exuberance of digital assets as a result of Coinbase Global’s COIN,

listed on the Nasdaq last week.

Bitcoin was off 1.8% on Wednesday morning in New York, changing hands at about $ 56,000 on CoinDesk. That puts the figure at about 14% below its all-time high of $ 64,829.14.

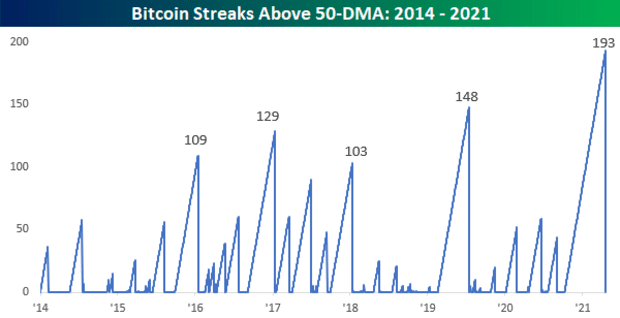

On Tuesday, researchers from the Bespoke Investment Group noted that Tuesday marked the first time Bitcoin was in a 24-hour period, in which it fell below the 50-day moving average since at least 2014, after record 193 consecutive days of impressions above this level. Bitcoin was first created in 2008-09.

Market technicians use moving averages as barometers of an asset’s upward and downward trends.

Tailor-made investment group

Pankaj Balani, CEO of Delta Exchange, in comments sent by email, said Bitcoin has managed to stay above the 50-day moving average in recent trading, but warned that a sustained short-term price breach it could lead to a drop of about $ 40,000.

The “50 DMA has been a crucial support for Bitcoin since October last year and has maintained that support every time in this rally. This time, however, we see that the momentum of Bitcoin is saved and BTC is fighting to maintain this support “, explained Balani.

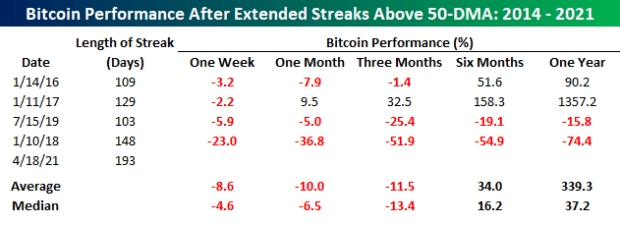

Tailored researchers noted that bitcoin tends to decline, in periods of one week, one month and three months, after upward trends lasting at least 100 days are introduced.

“A week later, [bitcoin] it fell fourfold by an average decline of 4.6% and fell fourfold. One and three months later, the performance was even worse, with average decreases of 6.5% and 13.4%, respectively, ”the report said.

Tailor-made investment group

JPMorgan Chase & Co. researchers JPM,

including Nikolaos Panigirtzoglou, wrote in a report Tuesday that Bitcoin’s declining momentum could mean a downward spiral for volatile assets. Analysts said not recovering $ 60,000 could be the trigger for a sharp drop.

The JPMorgan strategy points to the downward trends of the bitcoin futures markets BTC.1,

where institutional and professional investors will cover their exposures to cryptography.

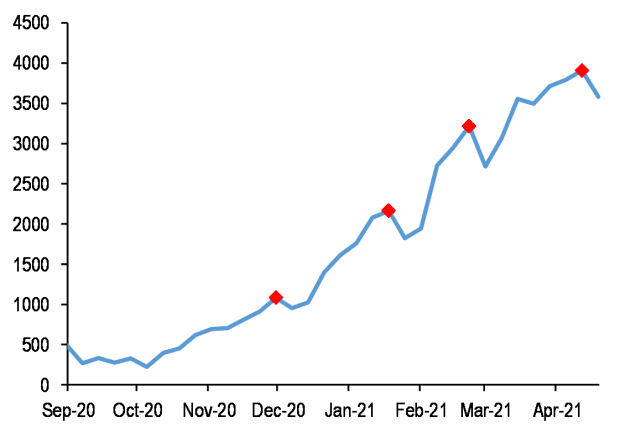

Bitcoin chart of JPMorgan figure 9

Referring to the attached chart, JPMorgan says the four episodes of more than a 10% drop in its future position, including the last few days, have been attributed to a higher trend disability.

“Similar to the previous three episodes, marketers are likely to boost, such as [commodity trading advisors] and cryptocurrencies, were at least partly behind the accumulation of long bitcoin futures in recent weeks and therefore also probably behind the unfolding of the last few days, ”JPMorgan concluded.

“If the price of bitcoin does not exceed $ 60,000 soon, the momentary signals shown in Figure 9 will naturally decline from here for several months, given its still high level,” analysts wrote.

JPMorgan researchers are not 100% sure that this time Bitcoin will continue a decline with a sharp higher setback, as seen in November and mid-February. It should be noted that analysts say that flows to bitcoin have been tempered and that the recession seems to be gaining strength.

So far this year, bitcoin prices have been on the rise, to date 94% more. In comparison, GC00 gold,

which is considered a rival to bitcoin, falls 5.5% in 2021. The Dow Jones Industrial Average DJIA,

and the S&P 500 SPX index,

both have increased by about 11% the previous year.