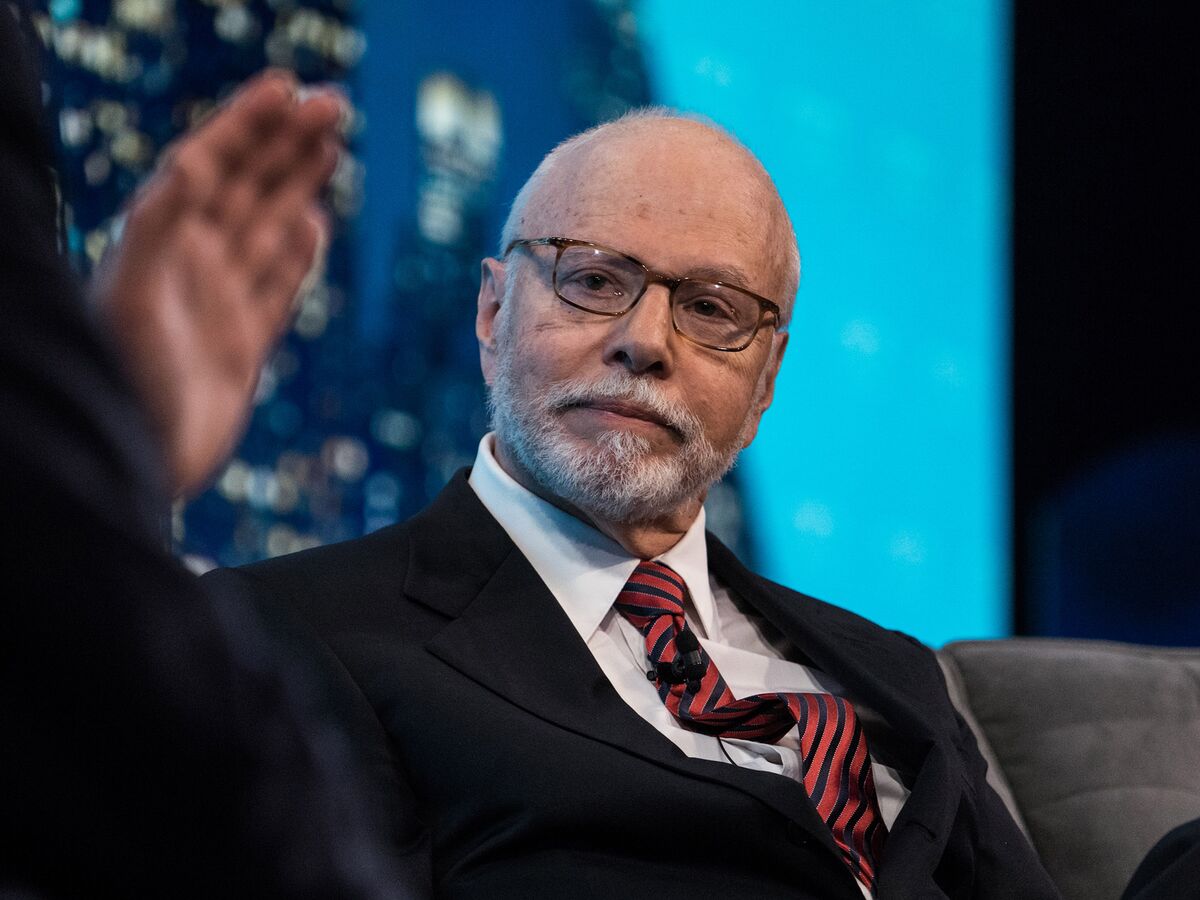

Paul Singer

Photographer: Misha Friedman / Bloomberg

Photographer: Misha Friedman / Bloomberg

Elliott Management Corp., a hedge fund known for its activist shareholder campaigns, is meeting with bankers to raise more than $ 1 billion to fund a special-purpose acquisition company, Dow Jones reported Sunday.

The process is at an early stage and plans could change, Dow Jones said, citing people familiar with the issue who were not identified. Elliott, founded by billionaire Paul Singer, could use the proceeds to buy a company potentially worth billions of dollars, based on targets that similarly sized SPACs have agreed to negotiate, according to the report.

Once an obscure investment vehicle, SPACs raised $ 83 billion on U.S. stock markets by 2020, accounting for approximately 46% of the total of all initial public offerings, according to data collected by Bloomberg . This year, at least 117 SPACs have already raised more than $ 35 billion, at the rate of another record year. SPACs pool funds to fund merger and acquisition opportunities.

It’s unclear what industries Elliott might have his gaze on, Dow Jones said.

Elliott, with more than $ 45 billion in assets under management, has shaken change in some of the world’s largest and most prominent companies, including Twitter Inc., Softbank Group Corp., AT&T Inc. And others.