The UK’s use of genomic sequencing to identify a more infectious strain of SARS-VOC-2 has largely served as an alarm clock for inappropriate use of technology in the US.

By mid-December, the United States had sequenced approximately 0.3% of its COVID-19 samples, a percentage that is significantly lower than in other developed countries despite having a quarter of the world’s cases.

In comparison, the UK is sequencing around 10% of its samples and Australia intends to sequence in real time the relatively limited number of COVID-19 positive tests.

“The United States has not demonstrated sequencing if you look at the world stage,” said Dr. Eric Topol, director of the Scripps Research Translation Institute. “Sequencing gives us many different things. It tells us how the virus moves from one place to another. It tells us how fast it changes. We can say he was here that day and he was there another day. It can be called a super-spreader “.

See also: This is what we know so far about the new COVID-19 strain

Growing concern about the new “hypertransmissible” strains of SARS-VOC-2 has raised awareness of the country’s lack of federal funding and the development of the type of genomic surveillance that helped the UK identify strain B.1.1. 7 and South Africa. identify strain B. 1,351 in December.

“We just don’t have the kind of robust surveillance capabilities we need to track outbreaks and mutations,” President-elect Joe Biden said Thursday when he called for a dramatic boost in sequencing and genomic sequencing as part of his 1, 9 trillion US dollars proposed. Rescue plan.

While a good chunk of the federal pandemic dollar has so far reached immediate needs, such as testing, contact tracking and helping drug manufacturers increase their vaccine manufacturing capabilities, experts are now pressuring the U.S. to build a stronger genomic surveillance system that can help public health departments identify new strains while better addressing regional or community outbreaks.

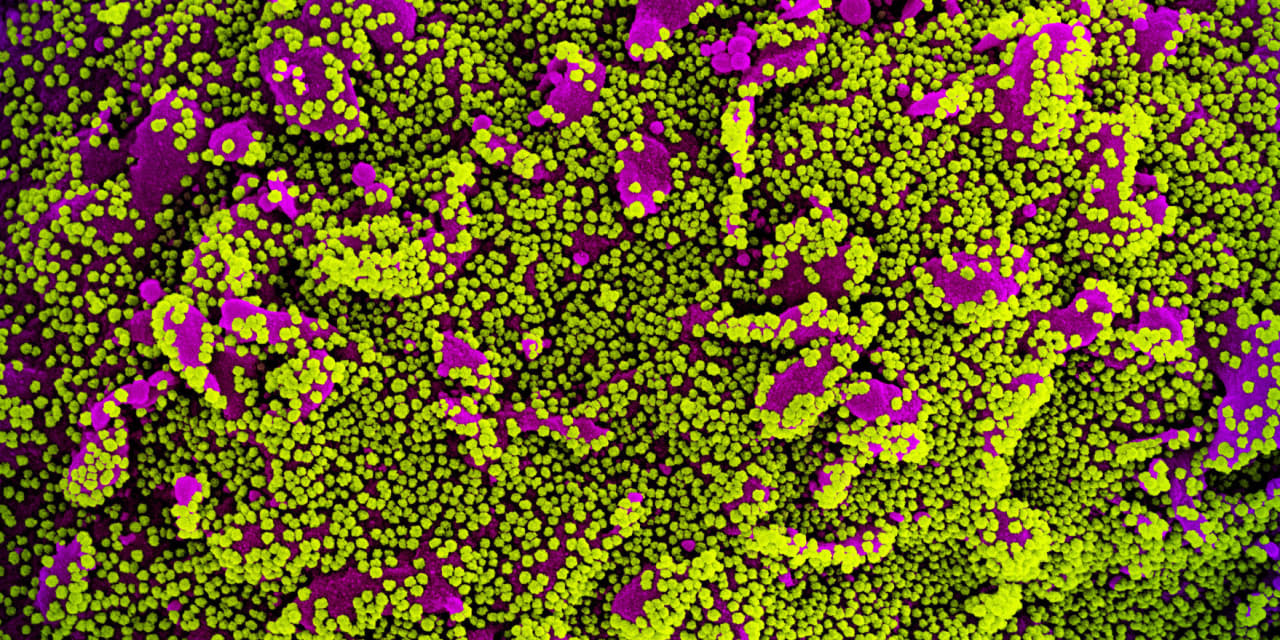

All viruses evolve and it is believed that SARS-VOC-2 develops one or two variants a month, although it mutates much more slowly than the flu virus. In mid-2020, researchers began talking about the 614G mutation, which is now considered the dominant form of the virus worldwide. Now, concern has passed to strains B.1.1.7 and B. 1.351, which are thought to be more infectious.

According to the Centers for Disease Control and Prevention, strain B.1.1.7 in the UK has been detected in at least 76 people in 12 states, as of January 13th. (South African strain B. 1,351 has not been identified in the United States at this time).

In the U.S., where rates of infections, hospitalizations, and deaths continue to rise, less emphasis has been placed on public-level public health initiatives when testing and care continue to be so in demand.

Read: Biden plans to distribute COVID-19 vaccine doses immediately

Intermountain Healthcare, a hospital system based in Salt Lake City, sent all positive tests for COVID-19 to sequence them in the early days of the pandemic. But when cases began to increase and the workload increased, the process began too disruptive and time-consuming and stopped, said Dr. Bert Lopansri, head of the Infectious Diseases and Epidemiology Division. Intermountain.

“With the increase in treatment options, the deployment of vaccines and the emergence of new variants, increasing sequencing is critical in the future,” he said in an email.

If the U.S. sequences at least 5% of COVID-19 positive tests, it could detect emerging strains or variants when they account for less than 1% of all positive cases, according to a model developed by the sequencing company Illumina Inc. ILMN,

(His model will be published this weekend as a prepress, a type of preliminary medical study).

That would cost less than $ 500 million in 2021, according to Dr. Phil Febbo, the company’s chief physician.

Experts say putting money behind a national genomic sequencing surveillance network can not only help identify new variants in the future, but can help overworked public health departments and prioritize who has been of testing, contact tracking and isolation.

It could also be used to inform vaccine manufacturers if there is a “vaccine escape strain,” a strain of the virus that could make currently available vaccines less effective or ineffective.

(A study performed in a laboratory on mice by BioNTech SE BNTX,

and Pfizer Inc. PFE,

demonstrated that its vaccine is still effective against new strains, according to the Jan. 7 prepress. Moderna Inc. MRNA,

he has also said he is confident his MRNA vaccine will work against the UK strain)

“When they see a small group of a new variant entering the community, they can react quickly,” Febbo said, “and they can sensitize the infected and make sure they do their best to contain them.”

See also: The FDA identifies 3 COVID-19 tests that may be affected by a new variant

Earlier this month, Illumina announced plans with a private testing company called Helix OpCo to develop a national sequencing monitoring system with CDC support. Helix is looking for samples of positive COVID-19 tests with the “abandonment of the S gene” for Illumina sequencing. To date, they have identified at least 51 cases of B.1.1.7. in the US

Incorporating genomic sequencing into national surveillance is not the only way to modernize the way the U.S. can track and act against the virus. Beyond testing, contact tracking, and isolation, this could include genomic sequencing, wastewater monitoring, mobility data collection, and use of digital sensors, according to Topol.

“As we get vaccinated completely, we will start to see the containment of the virus,” he said. “And then there will be places like the whack-a-mole, where the virus tends to emerge again. If you’re doing sequences, doing wastewater, digital, mobility, you basically have a real-time control panel in the country and you see ‘Oh, come on, Kalamazoo is lighting up’ ”.

Shares of Illumina have gained 18% in the last twelve months, while the XDR ETF of SPDR S&P Biotech,

has gained 59% and the S&P 500 SPX,

has gained 15%.