After Labor Day, investors return to the S&P 500 SPX,

near historic highs and some dark economic shadows lurking. Especially in the corner of concerns are Friday’s weak job data, which appears in a context of higher prices, leading to whispers of dreaded stagflation.

Supply chain problems created by the coronavirus and its variants increase this possibility of stagflation, Matt Maley, chief market strategist at Miller Tabak + Co, said in a note over the weekend. “If / when it does, both the stock market and the bond market will react in a very negative way (and probably very quickly),” he warns.

Maley has another warning for investors of ours call of the day, as it marks a list of “strong similarities” between current stocks and the able-bodied markets of 1999, 2007 and 1929. It doesn’t say we’re going to see a bear market like what happened during those years, but believes that “a correction deep and inevitable, ”is more likely than most Wall Street expects.

Here is this list of similarities:

-

The S&P 500 is trading at 22.5 times advanced high profits and 3.1 times its price-to-sales ratio is much more expensive than in 2000. The Nasdaq-100 QQQ tracking fund listed on the QQQ stock exchange,

+ 0.31%

it is trading at a premium of 70% compared to its 200-week moving average, the highest since 1999/2000. -

Companies for the acquisition of “blank checks” or special purpose acquisitions where investors have no idea what the investment will be. “The last time the SPACs were as big as they are today? That’s true in 1928/1929, ”the strategist said.

-

Make the most of it. Similarly to 1920 and 2000, margin debt has risen to new highs, which is good until it begins to move in the other direction. It has recently begun to disconnect and, if this continues, the markets have a problem.

4. Cryptocurrencies. Maley said it is longer-term bullish on cryptocurrencies, but worries about the “foam,” given a 1,000% gain for Bitcoin since the Federal Reserve’s massive quantitative easing program began in 2020, with Ethereum a 3,400%.

5. Individual investors account for 20% of the average daily volume of shares, twice as many as two years ago. Many large markets of the past (1929, 1999/2000) were marked by great leaps in investor activity.

6. From 1998 to 2000, many zero-income companies saw their shares rise and investors piled up, and Maley sees parallels with the actions of today’s so-called “memes.”

Maley said he does not predict a setback similar to those big years, and that timing any setback is obviously difficult. “However, we believe that the risk side of the risk / reward equation has grown substantially in recent months … and therefore we believe that investors should raise some cash at these levels.” he said.

“If / when this ‘rally of everything’ ends, the majority will decrease. Therefore, (at least) some cash will be one of the few hedges that investors will be successful if / when the market is corrected” , said Maley.

Soros warns about China and Match heads to the S&P 500

Barclays strategists raised the S&P 500’s target price to 4,600, from 4,400, as they don’t see the Federal Reserve declining triggering a “significant market sale”.

Famous investor George Soros exploded BlackRock BLK,

for recommending its investors to triple its exposure to China, in a Wall Street Journal published. Shares of China 000300,

by the way, it gained an increase on Tuesday from strong trade data.

Columbia Property Trust shares CXP,

they are firing after the real estate investment board announced a $ 3.9 billion deal that would acquire the funds managed by Pacific Investment Management (PIMCO).

Deutsche Telekom DTE,

will raise its stake in T-Mobile US TMUS,

will increase as part of a strategic alliance and stock swap with SoftBank Group 9984,

Match.com MTCH Stock,

news about the dating app company will be added to the S&P 500, replacing WW International WW,

heading for the S&P SmallCap 600 SML,

Goldman Sachs GS,

will list its alternative asset management unit Petershill Partners on the London Stock Exchange.

Faced with the fierce reaction on social media, video game developer Tripwire Interactive has replaced its CEO, who expressed support for a Texas abortion law in a tweet on Sunday.

The markets

Shares seem to hold near record highs, judging by future ES00s,

YM00,

NQ00,

action. European equities are giving up some gains as investors look forward to Thursday’s European Central Bank meeting. The Reserve Bank of Australia downgraded its own bond purchase at Tuesday’s meeting.

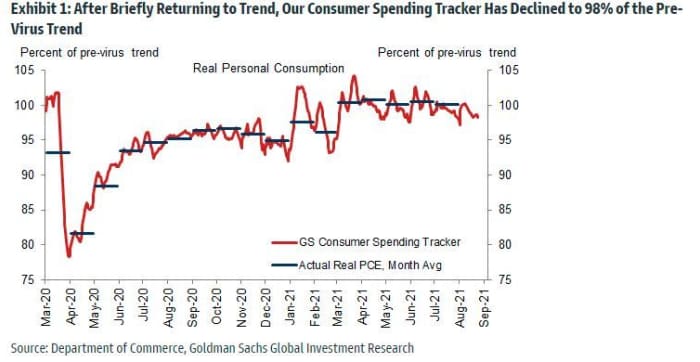

The graph

Goldman Sachs is concerned that the coronavirus delta variant, declining fiscal stimulus and slower recovery in the services sector will weigh on consumer spending over the coming quarters. Its vision of GDP for 2021 has fallen to 5.7% from 6.2%, but to 4.6% from 4.3% in 2022.

Random readings

Tributes are paid to the late Michael K. Williams of the fame of “The Wire” and “Boardwalk Empire.”

“A bloody fool,” said the captive-bred duck.

You need to know it starts early and updates up to the opening bell, but sign up here to receive it once in your email. The email version will be sent around 7:30 am East.

Want more for the next day? Sign up for The Barron’s Daily, a morning investor briefing that includes exclusive comments from Barron’s and MarketWatch writers.