Following a delay, payment technology company Affirm Holdings Inc. is about to be paid.

The company, which allows people to buy goods and pay over time, priced its initial public offering at $ 49 per share on Tuesday afternoon, according to Bloomberg News and Reuters reports. This price is $ 5 per share more than the top of its proposed range and would raise at least $ 1.2 trillion and allow the company an initial market capitalization of $ 11.9 billion, based on Commission statements Values and Change of Affirm.

Affirm AFRM,

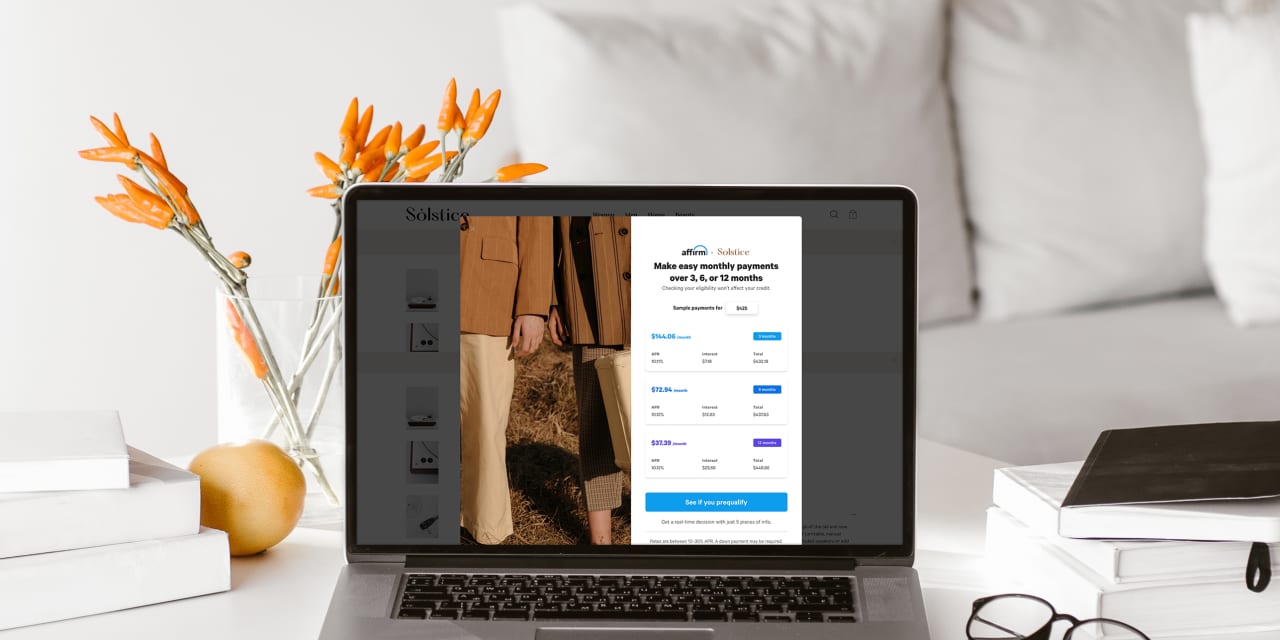

which was co-founded and led by PayPal Holdings Inc., co-founder of PYPL Max Levchin, allows customers to pay for online purchases over time. The company makes money with the end seller of a transaction when consumers use one of Affirm’s fractional products, the most lucrative of which offers a “0% APR” option that allows consumers to make purchases over time without generate interest. The company also has a “simple interest” loan option under which it charges consumers the down payment.

Executives planned to make Affirm public in late 2020, but ended up delaying the IPO after huge first days were made public among so-called unicorns, such as Airbnb Inc. ABNB,

and DoorDash Inc. DASH,

For more information: after a year of impressive pandemic deals, these technology companies hope to keep it running

The statement generated revenue of $ 509.5 million during its last fiscal year, which ended in June, up from $ 264.4 million the previous year. The company posted a net loss of $ 112.6 million, compared to a loss of $ 120.5 million in the previous period.

Brands that use Affirm for installment payment options include Peloton Interactive Inc. PTON. The connected exercise equipment manufacturer accounted for approximately 28% of Affirm’s revenue during its last fiscal year.

See also: Five things to know about Affirm when it goes public

Affirm is one of several players in the now paid shopping space. Competitors include Afterpay Ltd. APT,

trading in Australia; Klarna, which has received support from Visa Inc. V,

; and Uplift, which has focused on the online travel market.

Affirm is now expected to start trading on the Nasdaq on Wednesday with the symbol “AFRM. “In SEC filings, the company said it would try to sell 24.6 million shares and subscribers – led by Morgan Stanley, Goldman Sachs and Allen & Co. – have access to a global batch comprising 3.7 millions of additional shares.

Affirm’s IPO comes as the IPF of the Renaissance IPO ETF,

has gained 22% in the last three months and, like the S&P 500 SPX,

has increased by 7.6% during this period.