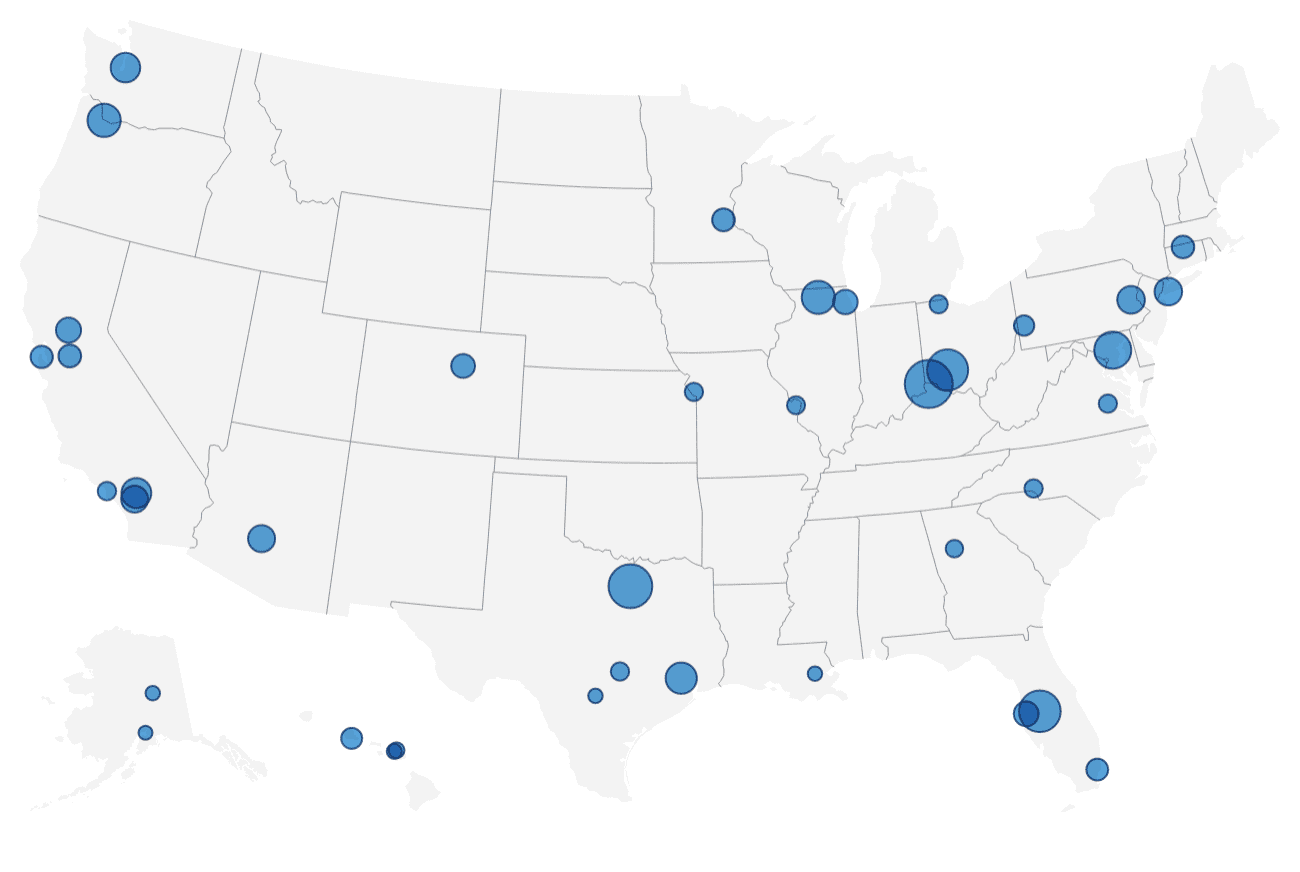

Source: Chaddick Institute, DePaul University. It shows only US airports and includes associated airlines.

Over the years, Amazon has amassed an army of warehouses, shipping centers, delivery vans, and trucks to ensure it can meet its delivery commitment in two days or less.

Amazon’s air fleet, which now has 75 aircraft, is another increasingly critical component of the company’s logistics machine. The fleet gives Amazon more control over its own packages and allows it to offer even faster shipments.

It also brings Amazon into direct competition with FedEx and UPS. Analysts have long predicted that Amazon is on track to become a “top-tier logistics provider” and predict that one day it will be able to fly packages for other companies, not just for items from its own stores.

The company’s latest air cargo expansion suggests that Amazon Air is striving to become a more serious competitor for traditional carriers.

Amazon Air now operates at 42 U.S. airports, having added regular flights to seven airports in the past six months, according to a study released Wednesday by DePaul University’s Chaddick Institute for Metropolitan Development.

This places 70% of the U.S. population less than 100 kilometers from an Amazon Air airport, compared to 54% in May 2020, according to the study.

Amazon Air’s growing footprint allows it to ship packages and inventory to areas within walking distance of a truck or delivery van away from a significant portion of the U.S. population, DePaul researchers said.

Amazon Air’s growing proximity to consumers is critical, as Amazon continues to increase the delivery speed of shipping from two to one day. Amazon’s drive to get products to customers with an ever-faster clip has led to higher shipping costs. Amazon spent more than $ 61 billion on shipping in 2020, up from nearly $ 38 billion the previous year, based on CNBC calculations using financial filing figures.

“Amazon Air’s expanded reach strengthened its ability to quickly move inventory through its multitude of warehouses and sorting services to make it possible to deliver the next day a large number of products to much of the American population, “according to the report.

Amazon launched its air fleet in 2016. The company still relies on external carriers Atlas Air Worldwide Holdings and Air Transport Services Group to fly a portion of its packages, but has begun bringing some air cargo operations home.

In January, the company announced its first aircraft purchases, buying 11 used Boeing 767-300 aircraft to add to its fleet of leased aircraft. Amazon’s airline fleet remains a fraction the size of FedEx, which has 467 aircraft, and the fleet of 284 UPS aircraft, according to data from planespotters.net.

Last month, Amazon opened its $ 1.5 billion “superhub” at Cincinnati / North Kentucky International Airport, which spans 600 acres and has an 800,000-square-foot robotic sorting center, where packages are ‘ordered by postcode and consolidated into trucks before delivery. The center could support up to 200 flights a day.

Amazon’s flight activity has increased 17% in the past six months to an average of 164 daily flights, DePaul researchers said. The researchers predicted that Amazon will expand its flight operations by another 12-14%, bringing its daily total to more than 180 in January next year.

Amazon is likely to be far from offering its air cargo services to third parties, as managing its own order volume is a full-time job, Joseph Schwieterman, director of the Chaddick Institute, said in an interview.

Sarah Rhoads, vice president of Amazon Global Air, told CNBC in an interview last month that the company is focusing on managing its own package volume.

That could change as the Amazon Air network continues to grow, Schwieterman said.

“If they can provide it to markets where they have coverage and capacity and maybe they don’t try to be everything to everyone, it could be a really nice profit center,” Schwieterman said. “The day will probably come when they are placed in the massive segment of the company’s logistics to the consumer.”

Amazon declined to comment on the report’s findings.