Coinbase Global Inc. cryptocurrency platform COIN,

on Wednesday it became the most valuable U.S. stock exchange as it ended the day trading at $ 328.28, valuing the company at nearly $ 86 billion diluted.

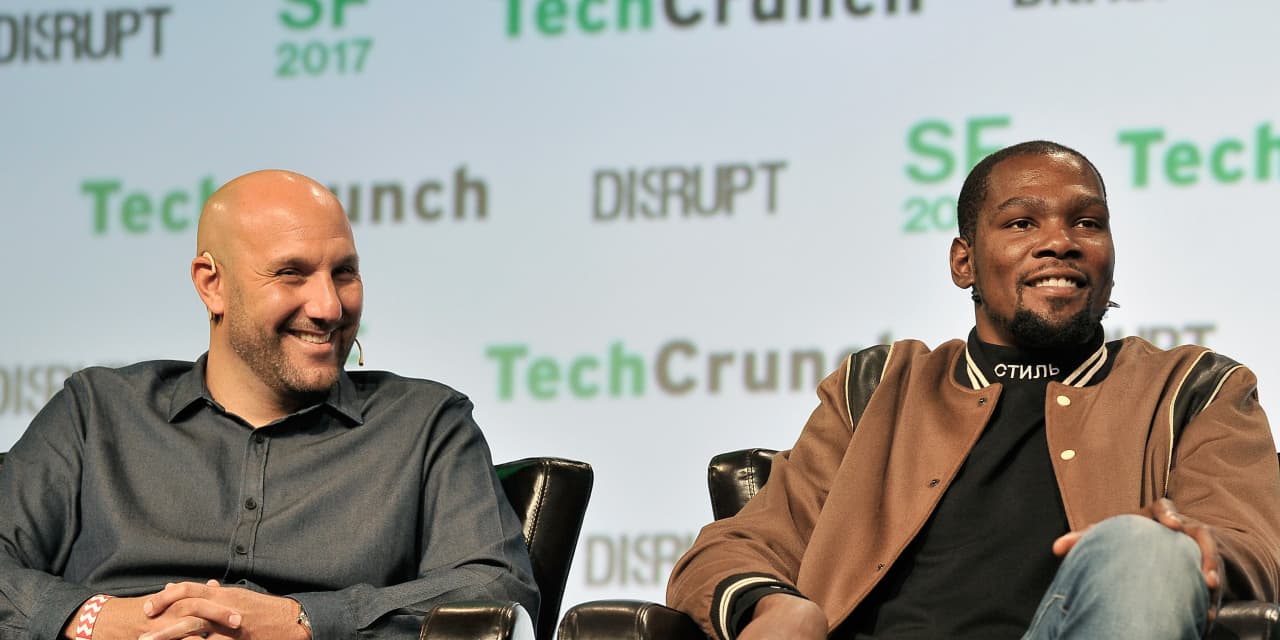

Brooklyn Nets star Kevin Durant, the third-highest winner in the NBA, was one of the investors who just entered the Coinbase IPO.

Through its investment company Thirty Five Ventures, Durant and business partner Rich Kleiman invested in Coinbase in 2017. At the time, Coinbase was securing capital for its Series D financing. This rounding of funding raised more than $ 100 million at a valuation of $ 1.6 billion, according to the business journalist Joe Pompliano.

The company, whose users deal mainly in BTCUSD bitcoins,

and ethereum ETHUSD,

it now has a valuation 53 times higher than Durant did during the investment, indicating a massive jump in the value of its investment.

It’s unclear how much Durant invested in Coinbase in 2017, but he has made million-dollar investments in the past, such as his $ 1 million investment in Postmates before his sale to Uber UBER,

in 2020. A $ 1 million investment in Coinbase in 2017 will be worth more than $ 53 million today.

Durant and Thirty Five Ventures have also invested in several startups, including financial services company Acorns, sports organization Andbox and alternative asset management company Alt.

See also: NFL Announces First Sports Book Partnerships in the United States – with Caesars, DraftKings and FanDuel

Other notable investors who charged with the IPO of Coinbase were the billionaire PayPal PYPL,

and LinkedIn co-founder Reid Hoffman, libertarian hedge fund manager turned venture capitalist Dmitry Balyasny, Google GOOG,

GOOGL,

Ventures founder Bill Maris, and strategy and political investor Bradley Tusk.

Coinbase Global cryptocurrency trading shares rose 1.4% on Thursday and some Wall Street analysts still say Coinbase is a buy.

In Thursday afternoon trading, stock benchmarks such as the Dow Jones Industrial Average DJIA,

gained 282 points, or 0.8%, of the S&P 500 SPX index,

is trading 42 points higher, with a gain of 1%, and the Nasdaq Composite Index COMP,

rises 160 points, or 1.2%.