On the first day of the joint appearance of Federal Reserve Chairman Jerome Powell and Treasury Secretary Janet Yellen on Capitol Hill, no one was surprised, but it set out the current plan for U.S. economic policy. Monetary policy will be let go until there is “maximum employment” and fiscal policy will be aggressive, although Yellen made it clear that the White House wants to pay to increase investment in infrastructure with higher taxes.

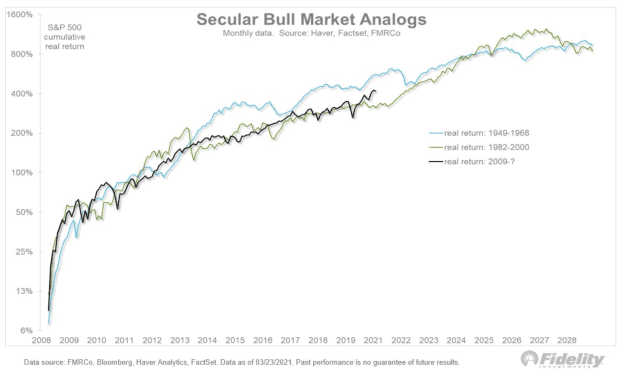

Jurrien Timmer, global macro director at Fidelity Investments, says fiscal and monetary policy “will remain at full swing for some time.” When this column last learned of Timmer, he said the 1960s provided a blueprint for what was to come for the stock market. Updated this chart to show that it is still on track.

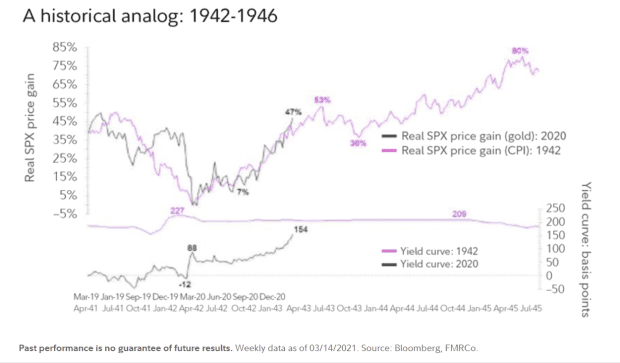

But another historical analogy is the period from 1941 to 1946. To mobilize against World War II, federal debt tripled, the Fed’s balance sheet multiplied by ten, and the Fed limited interest rates. in the short and long term below the inflation rate. Of course, the current book is not as aggressive (the Congressional Budget Office’s forecast for national debt in 2030 is only 6% higher than before the COVID-19 pandemic), but they are directly similar.

“The net result of the Fed’s rate cut in the 1940s was that real rates fell well below zero and remained so for several years as inflation took root. In my view, the Fed will accept higher inflation today, as will the Treasury. How else will the country emerge from its growing debt burden, ”Timmer says.

The result was a growing and broad stock market, at least until inflation really took off later in the decade. There was also a steeper performance curve, measured by the gap between 2 and 10 year yields.

The second day at Capitol Hill by Powell and Yellen

Powell and Yellen will speak Wednesday before the Senate Banking Committee. According to the Commerce Department, durable goods orders fell 1.1% in February, surprising economists who had predicted a small gain. The day will see flash readings of purchasing managers ’indices and four other Fed officials will also speak.

A huge cargo ship is trapped in the Suez Canal, blocking traffic on a key sea route.

GameStop GME,

the video game retailer, reported worse-than-expected earnings and said it would stop providing comparable store sales data as it tries to focus on more online deals. GameStop also named a former director of online retailer Amazon AMZN,

Jenna Owens, who will be head of operations.

Intel INTC microchip manufacturer,

said it will make a $ 20 billion investment in Arizona to build its manufacturing capacity, news that weighed on rival rival Micro Micro Devices AMD,

Manufacturer of electric vehicles Tesla TSLA,

will begin accepting bitcoin payments BTCUSD,

Executive President Elon Musk told TWTR on Twitter:

Tesla had said it would make that move in a previous regulatory filing when it announced $ 1.5 billion in cryptocurrency purchases.

Adobe ADBE software manufacturer,

reported stronger-than-expected first-quarter fiscal gains for the first quarter.

Hall of Fame Resort & Entertainment HOFV,

and Dolphin Entertainment DLPN,

both loosened up in a company to enter the non-consumable chips market.

Futures in higher stocks

It looks more hopeful after a tough Tuesday, in which the small-cap Russell 2000 RUT,

it sank 3.6%, its worst performance in a month. ES00 stock futures,

NQ00,

increased and the performance of the TMUBMUSD10Y to three years of the Treasury,

it fell even further, to 1.63%.

Oil futures CL.1,

rose, but were still below $ 60 a barrel.

Random readings

Heavy rains have created waterfalls in front of Uluru’s famous landmark in Australia.

Three dolphins toured New York City swimming in the East River.

You need to know it starts early and updates up to the opening bell, but sign up here to receive it once in your email. The email version will be sent around 7:30 am East.

Want more for the next day? Sign up for The Barron’s Daily, a morning investor briefing that includes exclusive comments from Barron’s and MarketWatch writers.