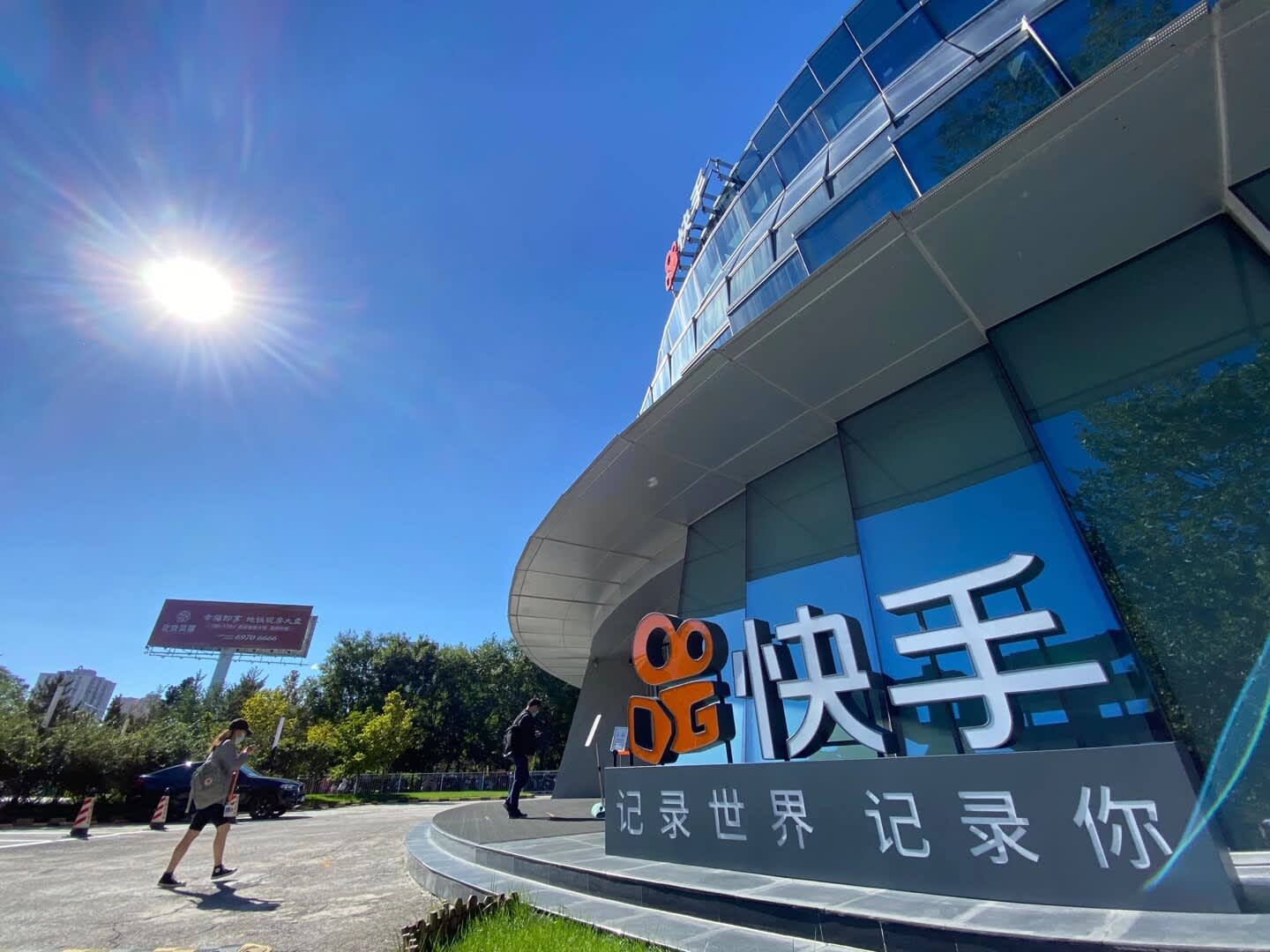

Kuaishou Headquarters is shown on November 5, 2020 in Beijing, China.

VCG | Visual China Group | Getty Images

GUANGZHOU, China – Shares of Chinese short video company Kuaishou rose nearly 200% when it opened in Hong Kong.

The technology company raised 41.28 billion Hong Kong dollars ($ 5.32 billion) from the initial public offering (IPO) after setting its shares at 115 Hong Kong dollars each, standing at the limit of its expected range.

Kuaishou shares opened at $ 338 Hong Kong.

The company’s main business is a short, money-making video app from users who buy virtual gifts to give to their favorite streamers. Kuaishou is also pushing new areas such as e-commerce.

Kuaishou said his IPO was too underwritten with high demand. If the so-called option is exercised globally, which allows the investment bank to issue more shares, Kuaishou could raise more than $ 6 billion.

Ten cornerston investors led by Capital Group and involving BlackRock and Fidelity invested in the IPO.

Kuaishou’s list will be a test of hunger for Chinese technology companies just as Beijing intensifies its control of the sector in areas from antitrust to data protection. In November, the Chinese government introduced rules on live shopping, which could affect Kuaishou.

The IPO is also another victory for the Hong Kong Stock Exchange, which has managed to attract high-profile technology companies and secondary quotes. Chinese companies listed in the US, including Alibaba and JD.com, have also raised money in Hong Kong. CNBC reported that Chinese video company Bilibili, listed on the Nasdaq, also filed a secondary registration in Hong Kong.

Kuaishou faces stiff competition in China from rivals such as Douyin, the Chinese version of TikTok owned by ByteDance, as well as Tencent’s WeChat messaging app.