Take out your popcorn and open up your business apps. After months of waiting, Federal Reserve Chairman Jerome Powell will comment on the economic outlook for the Jackson Hole economic symposium at the Kansas City Fed.

Expect it to accelerate, but don’t just announce, that the Fed will end its bond-buying program. The delta variant has suppressed advances in various economic indicators, ranging from airline travel to activity indicators for purchasing managers, so Powell will have reason to say: let’s wait a month or two for data before committing. with a taper.

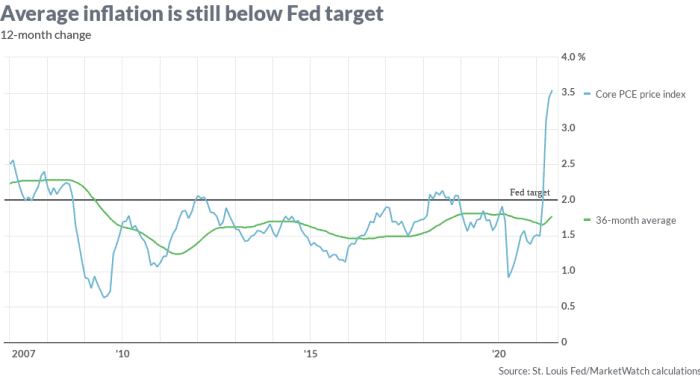

But there’s another reason the Fed should wait: the framework that Powell himself introduced in Jackson Hole last year, called the average inflation target. “We will try to achieve inflation that averages 2% over time. Therefore, after periods in which inflation has been below 2%, the appropriate monetary policy is likely to aim to achieve moderately above 2% inflation during some time, ”he said in 2020.

Now Powell did not define the “time” element. If the weather means three years, inflation remains below target, as shown in the graph. “Needless to say, the hurdle rate for rate hikes due to inflation is extremely high under the new Fed framework and this year’s move to U.S. Treasury rates was not justified.” , said Mondher Bettaieb-Loriot, head of corporate bonds at Vontobel Asset Management.

Bettaieb-Loriot may not be correct in his call, as the volume reduction is unlikely to be well into 2022; after all, during the July meeting at which “most” Fed officials said it would make sense to start cutting purchases, three-year average inflation was below target. In other words, the Fed’s commitment to its new framework has been unstable. It will be interesting to see if Powell makes a new commitment to it or not.

The buzz

Powell’s speech is due to be published at 10 a.m. in the East and throughout the day a group of other policymakers will be interviewed on major business news networks. Ahead are data on the July PCE price index, as well as data on July trade in goods.

There were a number of corporate profit launches delivered Thursday at the end. GPS Gap,

it increased as the retailer’s earnings far exceeded estimates, with online sales now accounting for a third of total revenue. Peloton Interactive PTON,

shares fell on the sports bike company’s outlook and price cuts. VMware VMW Enterprise Software Provider,

it also fell after its latest results.

The two largest US personal computer manufacturers, HP HPQ,

and Dell DELL,

Results were also reported, with HP missing sales estimates. Read: The PC boom is faltering as the most important era approaches

Apple AAPL,

will allow app makers to direct consumer payments outside of their App Store, a response to various antitrust lawsuits.

Microsoft MSFT,

has warned thousands of cloud customers that their databases may have been exposed to intruders, according to an email obtained by Reuters.

Tesla TSLA,

tries to sell electricity directly to Texas consumers, according to Texas Monthly.

China plans to ban initial U.S. public offerings for data-heavy technology companies, The Wall Street Journal reported.

Evacuations resumed in Afghanistan after the deadly attacks in Kabul.

The markets

US ES00 stock futures,

YM00,

he pushed higher before Powell’s speech. The performance of the Treasury TMUBMUSD10Y at 10 years,

fell to 1.34%.

Random readings

Did a UFO appear on a Florida highway?

An Austrian bank is trying to attract customers, with all the memes you can think of.

Need To Know starts early and updates until the opening bell, but sign up here to get it once in your email. The email version will be sent around 7:30 am East.

Want more for the next day? Sign up for The Barron’s Daily, a morning investor briefing that includes exclusive comments from Barron’s and MarketWatch writers.