On the last trading day in August, stock futures are on the rise as markets overtake China’s low economic news and concerns about the COVID-19 contagion continue. It’s all part of a relentless higher march for actions that have barely stopped this summer.

“The S&P 500 has posted at least one new closing maximum each week since the week of June 7, 2021, 13 weeks in a row. August 2021 has recorded 12 new closing highs in the 21 trading days, when missing a day to finish, ”noted Howard Silverblatt, senior index analyst at S&P Dow Jones Indices.

“Currently, the index has recorded 53 new highs and is equal to 4th the highest in the history of indices (1926), “added Silverblatt, who added that even if the market looks crazy,” if you’re not there, you’re crazy and you’re probably out of work. finger on the button). “

Our call of the day UBS Investment Director Mark Haefele sees the S&P 500 on a solid path to another big milestone: 5,000. This is its goal by the end of 2022, while the bank sees the index reaching 4,600 by the end of this year.

“The S&P 500 has surpassed 4,500 for the first time, making gains for 2021 by more than 20%. This may seem surprising given the recent spate of negative news, including disappointing US consumer data and continued growth. of COVID-19 infections, but we believe that the momentum towards reopening and recovery is intact and that there is an additional advantage in the actions, ”Haefele told customers in a note.

Highlights a list of supporting factors, including a fifth consecutive quarter of solid results, with more than 85% of companies exceeding second-quarter earnings and sales forecasts; the aggregate profits of the companies increased by almost 90% with respect to the levels of the previous year; gains almost 30% above pre-pandemic levels; and revenue growth so robust that it is an overwhelming cost pressure.

“We believe that cost pressures for companies should decrease as supply begins to recover. In addition, consumer balances are the strongest in recent decades due to the significant increase in l “Household savings over the past year and retailers will continue to repopulate to keep up with demand,” Haefele said.

Do you show us the stocks? “With the expansion of the economic recovery, we expect the cyclical sectors, including the energy and financial sectors, to take the lead,” he added.

Read: Since 1997, the S&P 500 has not had such a sharp rise so far.

The graph

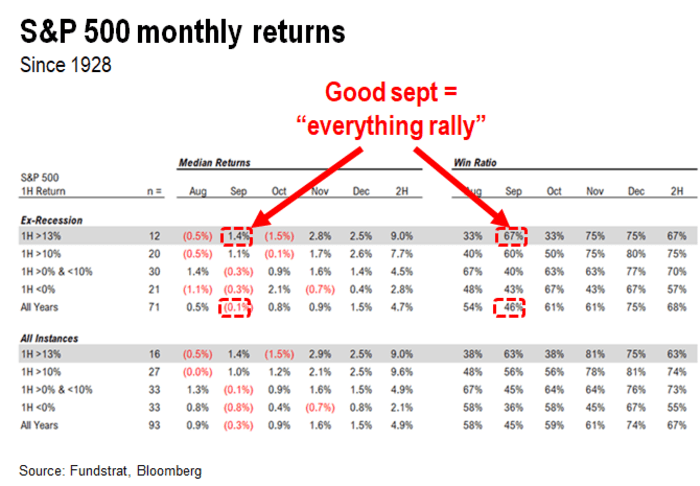

Thomas Lee, founder of Fundstrat Global Advisors, notes that history is on the verge of a strong September when markets present an equally optimistic first half.

This is so, as investors worry about “overbought” markets due to a downturn and statistics showing returns in September since 1928 have fallen by around 0.1%. In a note to customers, Lee says seasonality factors change when the first half is strong: the first six months of 2021 saw a 13% increase, the 10th best since 1928.

That should mean a stronger-than-expected September and an intact “all rally”. Here is his chart:

Read: If you have stock market nervousness, here are 20 companies from two defensive sectors

The delta drag of China and the advantage of the Modern vaccine

Zoom Video ZM,

shares plummet after video conferencing group reported its first quarter of $ 1 billion on Monday, but a somewhat disappointing outlook.

Robinhood HOOD,

the shares fall after SEC President Gary Gensler said so De Barron Monday that a controversial practice that generated billions for brokers and high-frequency commercial companies could be destroyed.

The official index of non-manufacturing purchasing managers in China contracted unexpectedly in August, dragged down by refrigeration service activity due to the outbreak of the Delta variant. The official indicator of factory activity also fell more than expected as demand weakened.

MRNA de Moderna,

The COVID-19 vaccine produced higher levels of antibodies to Pfizer PFE,

and BNTX from BioNTech,

according to a study of more than 2,000 Belgian health workers.

The Centers for Disease Control and Prevention raised their COVID-19 travel advice for Germany and gave the highest-level warning to Switzerland, Guam, St. Lucia, Puerto Rico and Guam, among other places. That move on Monday came as the EU removed the United States from its list of safe travel.

More than a million people are without electricity in Louisiana and Mississippi after Hurricane Ida, and officials warned it could be weeks before severely damaged power grids could be repaired.

Across the country, thousands of people fled the South Lake Tahoe resort in California on Monday, in a one-off traffic on Monday when the Caldor fire jumped off highways.

Tuesday’s U.S. data includes the national Case-Shiller home price index for June, the Chicago PMI and the consumer confidence index, both for August.

The markets

Ahead of the data, futures on ES00 shares,

YM00,

NQ00,

point higher, but crude CL00,

is submerging. Three-month aluminum prices on the London Metal Exchange were the highest since May 2011, driven by China’s production cuts. The DXY Dollar,

is under pressure. Bitcoin BTCUSD,

traded lower.

Random readings

US Open champion Naomi Osaka has her eyes set on the crypts.

Kid Gate hits the TV interview of the mother of politics in New Zealand, waving a rude carrot.

What you need to know is that it starts early and is up to date with the opening bell, but sign up here to receive it once in your email. The email version will be sent around 7:30 am, Eastern Time.

Want more for the next day? Sign up for Barron’s Daily, a morning investor briefing that includes exclusive comments from Barron’s and MarketWatch writers.