Is Wall Street ready to end a five-session losing streak? Stock futures say yes, but they have let us down sooner. Thus, so far September is shaping up in the same way that many experts predicted, haunted by seasonal weakness and the fall of the ongoing pandemic.

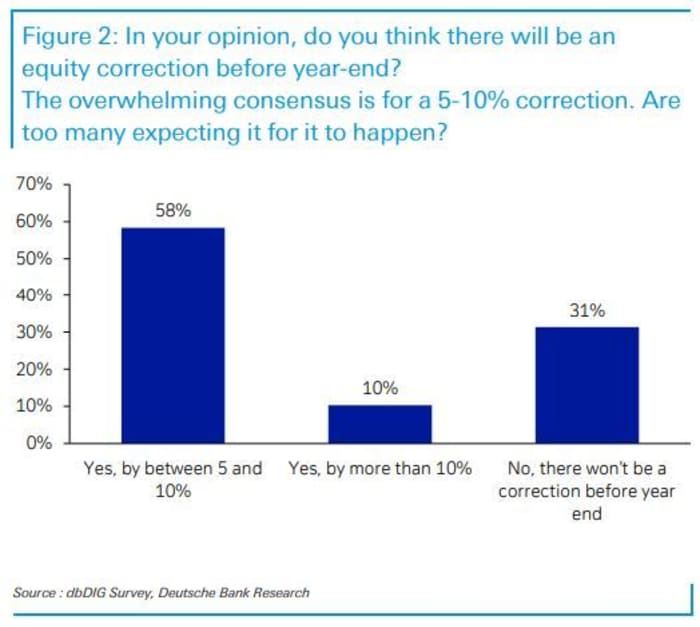

Our call of the day comes from a new survey by Deutsche Bank, which finds that 58% of the 550 professionals in the world market surveyed now expect a decline in shares from 5% to 10% by the end of 2021.

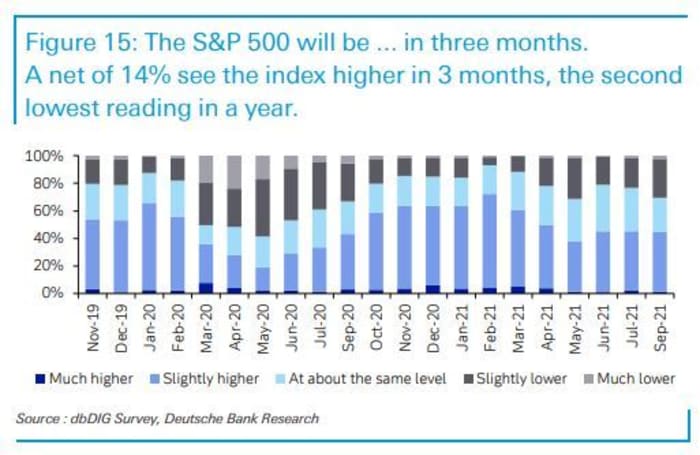

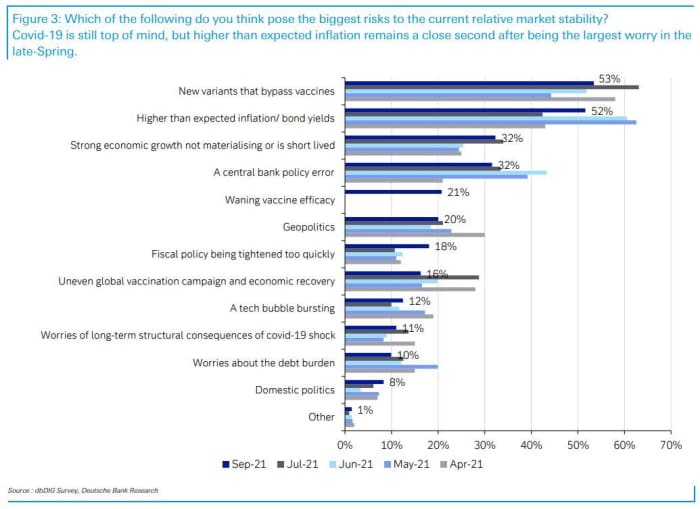

Valuations are just another brick in the wall of concern that investors continue to climb, which includes the delta variant, inflation, declining central bank volume, rising shipping costs that could hurt Christmas , etc. The following Deutsche Bank chart shows the two main neck bricks:

But, like Deutsche Bank strategist Jim Reid and research analyst Karthik Nagalingam, they also ask the question (included in the chart above): “Is there too much waiting for it to happen”? Last week, the bank’s chief strategist, Binky Chadha, warned of a “hard correction” amid rising ratings, amid caution from other big banks.

And touching on the issue of the “wall of concern,” also last week, Lisa Shalett of Morgan Stanley Wealth Management predicted a 15% decline for a market she considers “a price of perfection.”

Shalett, in advising investors to make gains on index funds, said this: “The strength of major US equity indices during August and early September, pushing new highs even more daily and consecutive in the face of worrying developments, it is no longer constructive in the spirit of “climbing a wall of concern”.

Read: The $ 1 trillion that has reached global stocks in 2021 is greater than the last 20 years together

Beijing turns off the heat of Jack Ma

Shares in the US of Chinese technology giant Alibaba BABA,

9988,

they fall after a report that Chinese regulators want to break Alipay, the popular payment app of Jack Ma’s ant group. There were other tech stocks in the red, including Tencent 700,

XD 2400,

and NetEase 9999,

DETECTOR,

as regulatory arrows continue to fly across the country.

Shares of Soho China 410,

410 fell 36% Monday after Blackstone Group BX,

rejected a $ 3.04 million bid for the commercial real estate operator.

Apple AAPL,

may be waiting to divert attention from a strong legal battle over its annual fall event on Tuesday, where the iPhone 13 and other handsets are expected to be unveiled. Epic Games plans to appeal against last week’s ruling that it could not call the app store the tech giant a monopoly. The creator of the video game Fortnite got a court victory after a judge ruled that the iPhone maker cannot force developers to use its payment system.

A fourth COVID reinforcement shot? Israel is reportedly weighing that possibility.

House Democrats want to raise corporate taxes to 26.5 percent from 21 percent and throw a 3 percentage point surcharge on individual revenues above $ 5 million, according to reports.

The federal budget will be released later, one day ahead of what could be the biggest number of the week, August consumer prices.

The markets

YM00 futures,

ES00,

NQ00,

they are superior, after the worst weekly performance in almost three months. SXXP European Shares,

have finished, but Asia had a mixed day, with the Hang Seng HSI,

falling 1.4% on these new technology regulatory issues. CL00 oils,

NQ00,

increases, along with the DXY dollar,

The graph

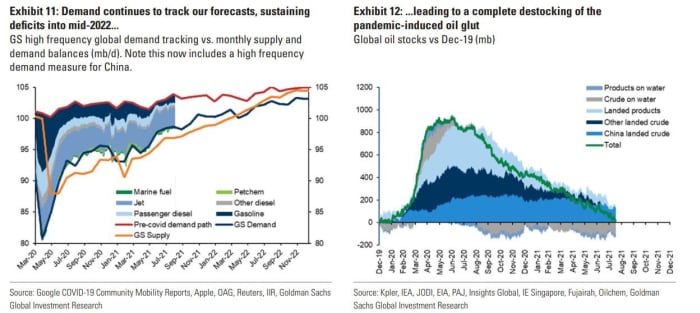

European gas futures are deteriorating recently due to shortages in Norway and Russia. Our chart of the day comes from Goldman Sachs, which warns that this scenario is repeated among global commodities, as investors remain little invested.

European energy price dynamics offer a “vision of what is reserved for others

commodity markets in the coming months as micro-factors are increasingly at the forefront, with widening deficits depleting inventories leading to high price volatility as markets struggle to find a balance said the team of analysts led by Jeffrey Currie, who is monitoring the crude.

“If oil reached our 80 / bbl. Target, it would be difficult for investors to ignore inflation in major physical commodity markets. That’s why we see oil as a catalyst this fall to attract investors to the market. ‘space that should also help prices on the margins,’ they said, noting the ‘attractive’ entry points for base metals, with copper only at 10% of the 2021 highs.

Keep in mind that Bank of America sees crude as reaching $ 100 this winter, depending on how cold it gets.

Random readings

From MTV’s VMA Award, the gift we didn’t know we needed: Doja Cat singer’s chicken feet:

And Miami fans saved a cat that fell with an American flag:

You need to know it starts early and updates up to the opening bell, but sign up here to receive it once in your email. The email version will be sent around 7:30 a.m. East.

Want more for the next day? Sign up for The Barron’s Daily, a morning investor briefing that includes exclusive comments from Barron’s and MarketWatch writers.