With broader commodity indices in a coma this week, the discussion on financial markets continues to wake up retail investors in the U.S. stock market.

Global stocks recorded the largest weekly cash inflow in history, at $ 5.8 billion, Bank of America said, citing EPFR Global data. Not all of this money comes from day traders, of course, but it is a sign of frenzy. Michael Every, global strategist at Dutch bank Rabobank, raises an interesting question. “You just see the stability of a system really pushing it logically to its limits, which we are doing on multiple fronts,” he says. “How will it work if 50% of people decide to negotiate central bank liquidity on a daily basis to get a free trip to prosperity,” he asks. “Viouslybviament, someone needs to cook and deliver pizzas to traders these days.”

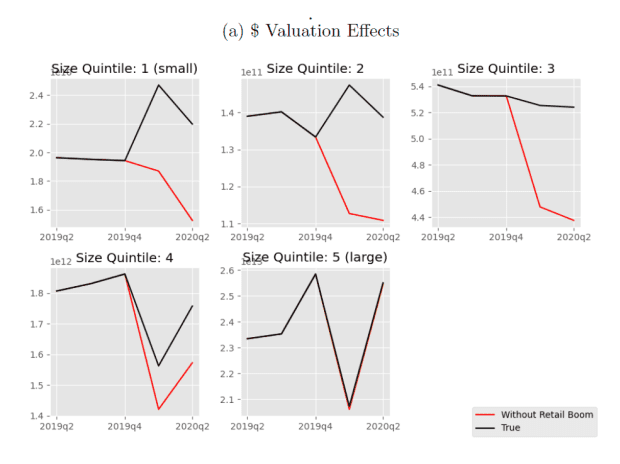

This question, for now, will remain unanswered (and in any case, these are chicken tenders, not pizza, for the people at Reddit WallStreetBets). But new research quantifies the impact of the retail investment boom on the U.S. stock market. Using Robinhood Markets ’holding data and 13-F presentations from large portfolio managers, the researchers were able to estimate retail and institutional demand.

The impact was massive. Robinhood traders accounted for more than 7% of the change in stock returns during the second quarter, the researchers found. Without the Robinhood crowd, the aggregate market cap of the smallest quintile of U.S. stocks would have been more than 30% lower.

Some well-known companies have been relocated by Robinhood, long before the GameStop craze began. F from Ford Motor Co.

profitability would have been less than 7.5 percentage points in the first quarter of 2020 without Robinhood and General Electric GE retailers,

would have dropped 2.75 points more. In the second quarter, Ford’s return would have been less than 20 percentage points, and Delta Air Lines DAL,

and United Airlines UAL,

they would have been more than 15 points worse each, the researchers said.

The researchers, Philippe van der Beck, of the École Polytechnique Federal de Lausanne and Swiss Finance Institute, and Coralie Jaunin of the University of Lausanne and Swiss Finance Institute.

Read this last sentence again and think about it. A large part of the stock market doesn’t care what the price is. Why should they? Very popular index funds seek to replicate indexes at any cost. The researchers said that because of all the attention paid to short sellers, the Robinhood crowd can affect the price of large companies that are mostly passive institutional investors.

And while van der Beck and Jaunin focused their analyzes on 2020, they did analyze the current situation. Yes, the video game retailer GameStop GME,

and the AMC Entertainment AMC movie chain,

extraordinary rallies took place as retailers organizing on Reddit’s WallStreetBets forum extracted hedge funds. But what about the headset maker Koss KOSS,

with negligible brief interest, which went from $ 4 to $ 110?

They applied their methodology specifically to GameStop. The purchase of 10% of GameStop’s outstanding shares could have resulted in a 57% rise in the share price, according to institutional property in July, the researchers said.

The buzz

Entertainment conglomerate Walt Disney Co. DIS,

rose 2% in premarket trade as it reported a surprise profit in the fourth quarter, as subscriptions to Disney + streaming service grew to 94.9 million.

Datadog DDOG cloud monitoring service,

it fell 5% as it offered a 2021 outlook below Wall Street estimates. Cloud security company Cloudflare NET,

it fell 6% after earnings forecasts met Wall Street estimates.

Bausch Health BHC,

increased 5% in pre-market trade, as activist investor Carl Icahn participated nearly 8% in the generic drug maker.

The group of seven finance ministers and central bankers will hold a virtual meeting, with a reading around 10am in the East.

The University of Michigan Consumer Sentiment Index highlights the economic calendar. The UK recorded a 1% increase in gross domestic product in the fourth quarter, which, however, limited the 9.9% recession to 2020, the worst performance in 300 years. Read what happened 300 years ago.

The market

US stock futures ES00,

NQ00,

they were lower on Friday morning, with most of Asia closed for New Year celebrations.

The gap between the performance of the Italian TMBMKIT-10Y,

and the German TMBMKDE-10Y,

Ten-year bonds fell to their lowest level in six years as the 5-Star Movement overwhelmingly backed membership in a government led by Mario Draghi, the former president of the European Central Bank.

The tweet

“Pink Elephants on the Moon” is a way to describe the current market environment.

Random readings

It’s worth checking out this 2015 profile of Whitney Wolfe Herd’s Vanity Fair, now a multimillionaire after Bumble’s BMBL online dating app,

commercial debut on Thursday.

Red wine, champagne and baked Alaska, the 117-year-old nun who survived the COVID-19 celebrated in style.

These pigs can play video games, and they’re pretty good too.

You need to know it starts early and updates up to the opening bell, but sign up here to receive it once in your email. The email version will be sent around 7:30 am East.

Want more for the next day? Sign up for The Barron’s Daily, a morning investor briefing that includes exclusive comments from Barron’s and MarketWatch writers