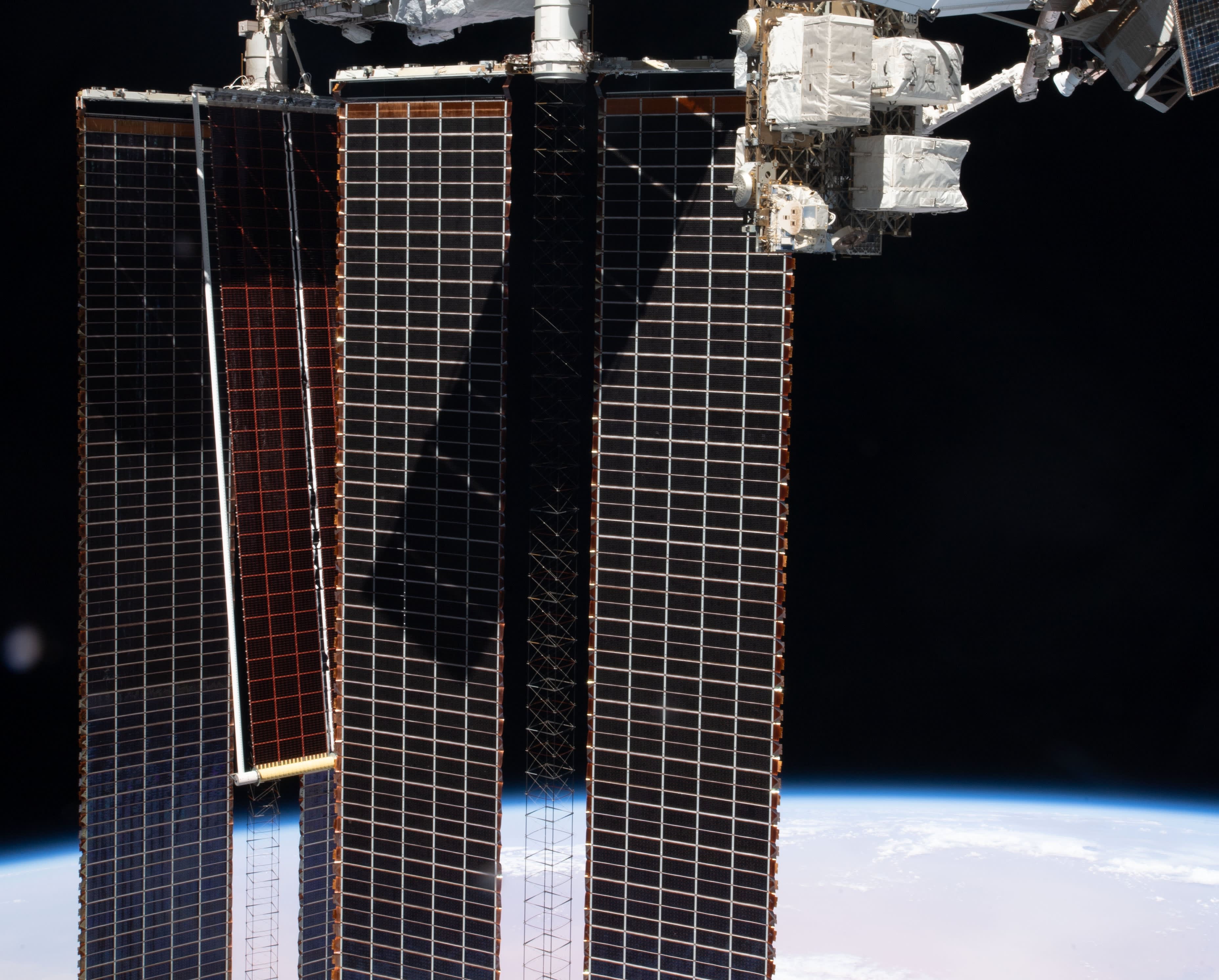

The new ISS Roll-Out Solar Array (iROSA) is deployed covering part of the main solar network of the International Space Station

NASA’s Johnson Space Center

Space infrastructure conglomerate Redwire began trading on the New York Stock Exchange on Friday, joining a group of space companies that closed SPAC mergers and went public.

“We are really making an effort to get the message out over the wider SPAC noise that we are a positive company in terms of revenue, positive in cash flow, very conservative financially and with fast growth,” he told CNBC the president and CEO of Redwire, Peter Cannito.

Redwire, formed last year by private equity firm AE Industrial Partners, merged with special-purpose acquisition company Genesis Park, and is now listed under the “RDW” label.

Shares of Redwire rose up 20% in trading since its previous close of $ 10.50.

Redwire is the sixth space company this year to close a SPAC deal and go public, after AST & Science, Astra, Spire Global, Momentus and Rocket Lab. Several space companies are expected to go public before the end of the year, with ongoing business from BlackSky, Satellogic and Planet.

Cannito stressed that the merger with a SPAC “was just a convenient mechanism to make itself public” for Redwire, with the benefit of adding up to $ 170 million in cash from the deal. The merger valued Redwire at $ 675 million in equity.

Redwire, which has spent much of the past twelve months acquiring and integrating seven space companies into one, plans to use that cash to continue creative “F&A” and make “some internal investments” along the way, Cannito said.

“We have a number of really exciting opportunities that we’re looking at right now,” Cannito said.

He also stressed that Redwire is “uniquely positioned from an investment perspective,” as it is a pure space park that generates more than $ 100 million in revenue a year and that the cash flow is positive. Cannito referred to the Space ARKX ETF, created by Cathie Wood’s Ark Invest, as a rookie without many “options that could go into it.”

“We give investors a chance … to invest in the future of the space with the company that has a conservative financial position and therefore maintain the power to be there for the long term,” Cannito said.

Associations and offers throughout the industry

Redwire’s chief of operations, Andrew Rush, shows former NASA administrator Jim Bridenstine a spacecraft model from the Made In Space subsidiary.

Redwire Space

Redwire’s vision is to provide “people who live and work in space” with the tools and manufacturing needed to grow the economy in orbit and beyond, Cannito said.

Redwire has five areas of strategic focus: space marketing, digital engineering spacecraft, in-orbit services and manufacturing, advanced sensors and components, and knowledge of the space domain.

The company has surpassed several milestones since announcing its intention to merge and go public.

SpaceX delivered the company’s iROSA solar arrays to the International Space Station. In addition, Redwire sent a new 3D printer into space to demonstrate manufacturing with lunar surface material, won a Virgin Orbit contract to deliver digital engineering solutions, signed an agreement with Sierra Space for in- space and announced Firefly Aerospace as a lunar lander mission partner.

Overall, Redwire provides hardware and services for space infrastructure, which it currently estimates is a $ 15 billion market.

Become a smarter investor with CNBC Pro.

Get stock selections, analyst calls, exclusive interviews, and access to CNBC TV.

Sign up to start one free trial today.